By: Andrew Elbaz and Student-at-Law, Alexander Katznelson

Nowadays, you would be hard pressed to find a crowded room where cryptocurrencies or blockchain technology were not being discussed. The explosive growth of cryptocurrencies has led many to invest in this industry. Without issuing or offering shares and without offering any collateral, companies were able to raise nearly $4 billion in 2017 through Initial Coin Offerings and Initial Token Offerings. Despite the hype in cryptocurrencies and blockchain technology, few understand the concept of digital money and the blockchain technology that facilitates its operation. This article will be the first in a series which will set out the landscape of cryptocurrencies and blockchain technology. We will begin by covering some of the fundamental terms used in these new industries.

What are cryptocurrencies?

Coins or tokens, often referred to as cryptocurrencies, are a digital means of storing value, alternative to the standard or traditional monetary system. Common, but non-essential components of cryptocurrencies include reliance upon a decentralized ledger known as a blockchain, the use of cryptography (the science of encryption) to secure and validate peer-to-peer transactions, and a higher degree of anonymity than is offered through centralized banking systems.

What is a blockchain?

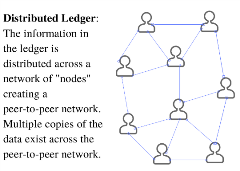

Blockchain technology can have hundreds, if not thousands of applications, however for the purpose of this explanation we will only consider its application to cryptocurrencies. In its simplest form, a blockchain is often a distributed ledger that consists of a continuously growing list of records, updating with each transaction. It is a secure by design database that details the current and historical ownership of all coins of a particular cryptocurrency.

Blockchain technology can have hundreds, if not thousands of applications, however for the purpose of this explanation we will only consider its application to cryptocurrencies. In its simplest form, a blockchain is often a distributed ledger that consists of a continuously growing list of records, updating with each transaction. It is a secure by design database that details the current and historical ownership of all coins of a particular cryptocurrency.

Why did Bitcoin succeed where others failed?

Digital currencies, similar to digital files like an mp3 file, could be copied and shared without any cost. In other words, if you had an “e-dollar” as a digital file, you could copy and share that “e-dollar” at your leisure. As we all know, the value of something is intrinsically connected to its scarcity. Thus, if the quantity of an “e-dollar” was virtually infinite, then it would lose all of its value. Bitcoin, the first digital currency operating on a blockchain, solved the problem of lossless replication of digital currencies virtually without cost.

What is Bitcoin?

Bitcoin, which launched in 2009, is a decentralized means of exchange, by which value can be securely transferred electronically. Much like fiat currencies, Bitcoin can be used to make purchases or pay for services. However, there are several key distinguishing factors between Bitcoin and fiat currencies. New Bitcoins are not entered into circulation by a central authority. Rather, Bitcoins are created through an algorithm to compensate miners for successfully validating transactions. This algorithm will continue to produce Bitcoins until there are 21 million Bitcoins in circulation. Currently, at the time of writing this article, there are 16,917,150 Bitcoins in circulation. Additionally, Bitcoin transfers are immutable. Meaning that, unlike electronic transfers via a trusted authority (e.g. PayPal or banks), once a Bitcoin transfer is “posted” on the Bitcoin ledger it cannot be undone.

What is Bitcoin mining?

Bitcoin mining is the process through which Bitcoin transactions are verified and new Bitcoins are put into circulation. As noted above, miners receive a portion of a Bitcoin as a reward for successfully validating a Bitcoin transaction.

When there is a Bitcoin transaction, prior to it being recorded on the blockchain ledger in what is known as a “block”, entities around the world receive notice of an unconfirmed transaction. These entities, commonly referred to as miners, run a computer program which by trial and error attempts to verify the transaction. Once the transaction has been verified, the transaction is recorded on the blockchain in a block and the miner is rewarded with a portion of a Bitcoin.

What are altcoins?

Alternative coins, also known as altcoins, are cryptocurrencies other than Bitcoin. Altcoins usually refer to cheaper coins, but with the recent boom in cryptocurrencies, several altcoins have reached multibillion dollar market capitalizations. People usually create altcoin projects to solve some perceived weakness in Bitcoin, or to tailor the coin to some specific niche.

So far, Ethereum has produced the most successful altcoin, Ether, which is currently the largest altcoin by market capitalization. The developers of Ethereum built what is often touted as the second and more future looking generation of blockchain technology – Blockchain 2.0. The Ethereum blockchain enables each block of the blockchain to contain code that will only execute when certain preconditions are met. This function is commonly referred to as a smart contract. Ether, a cryptocurrency which operates on the Ethereum blockchain, is used to compensate miners that validate transactions on the Ethereum blockchain.

Another altcoin with a high market capitalization is Ripple. Ripple is a real-time gross settlement system that operates on a closed blockchain. It utilizes its blockchain to facilitate the near instantaneous transfer of funds. Ripple can also be used as a currency exchange or as a remittance network. There are several features which distinguish Ripple from other cryptocurrencies. To name a few: Ripple’s blockchain is centralized, it does not compensate its network of validators, and all 100 billion Ripples (“XRP”) were created at the time of launch. Of that 100 billion, the current circulating supply of XRP is 30 billion. Although Ripple Labs cannot create any new XRP, it controls the rate at which additional XRP are put into circulation.

What is an initial coin offering (“ICO”)/ initial token offering (“ITO”)?

ICO/ITOs are a method for organizations to raise capital, often to fund development and/or growth, without diluting the shareholders’ interests in the company. Often, participants in ICO/ITOs can purchase coins or tokens using fiat money or other cryptocurrencies. In many ways, ICO/ITOs resemble initial public offerings (“IPOs”), as the coin or token often functions as a security of the business, fluctuating in value depending on the business’ success. In other cases the token’s value will be based on an ecosystem developed by the business, for example, as an in-game currency.

Please contact the authors, Andrew Elbaz and Alexander Katznelson, for further information on blockchain technology, tax planning for cryptocurrency investments, ICO/ITO compliance with securities laws, cryptocurrency exchanges, and anti-money laundering and know your client protocol compliance.