Changes to the ‘Plus One’ rule and reporting requirements for principal residence exemption

Last year, the federal government altered the rules for the principal residence exemption (PRE) by closing some loopholes surrounding the capital gains exemption as they relate to the sale of your home as well as making changes related to ownership of a principal residence by a trust. I detailed these in the previous articles in this series. But the feds aren’t quite done with you yet. There are changes to the so-called “Plus One” rule as well as to reporting requirements.

Changes to the “Plus One” rule

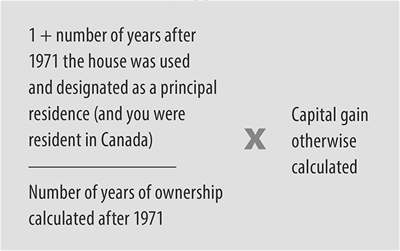

To re-cap, eligibility for the principal residence exemption is on a year-by-year basis, which might come as a surprise. The more years you qualify relative to your total period of ownership, the more your gain gets reduced. To be more precise, here is the basic formula that normally applies:

Despite only allowing one property to be claimed, the rules allow a full exemption on two residences in a particular tax year, i.e., where one residence is sold and another is purchased in the same year. That is why the formula adds “1” to the number of years the property was a principal residence (hence, the “Plus One” rule).

Effective Oct. 3, 2016, the Plus One rule will not apply where an individual is not a resident in Canada during the year of acquisition. Under the previous rules, you could benefit from the PRE for the year that you purchased a residence in Canada, even though you were not a Canadian resident in the year of acquisition. This is no longer the case; however, a non-resident may be able to avoid this result by gifting funds to his or her resident spouse or child to acquire the property.

Changes to reporting requirements

If your entire gain is covered by the PRE, we had noted that under the previous rules, you were not required to file the designation form with your tax return to report the disposition of the principal residence. However, under the new rules, you are now required to report the sale of your principal residence and make the designation. This applies for all dispositions that occur on or after Jan. 1, 2016. If you fail to do so, you will not be entitled to the PRE. In certain circumstances, the CRA will accept a late designation of your principal residence, but you could be subject to a penalty of up to $8,000.

Under the previous rules, the CRA could only reassess you within the normal reassessment period, which was generally three years after the date of the original Notice of Assessment (unless certain exceptions are applied). The new rules clarify that the CRA has the ability to reassess you for an unlimited period beyond the normal reassessment period (as it relates to your principal residence) if you failed to report the disposition of your principal residence, even if such failure to report was purely innocent.

Key points to remember

These are the two main take-aways from these new changes:

1. There is no longer any flexibility through the use of a family trust for owning a principal residence (usually popular with the purchase of a cottage property).

2. Do not assume that a sale of your home will no longer trigger any tax compliance on your part. If you sold your home on or after Jan. 1, 2016, you must report the sale and make the proper designation, or the PRE will not be allowed.

As always, if in doubt, or if your situation is complicated, it’s prudent to consult a qualified tax practitioner.

Previously published in The Fund Library on May 4, 2017 by tax and estate planning lawyers, Samantha Prasad and Ryan Chua.